The market for responsible investments in Australia has continued to soar in popularity to $1.2 trillion in 2020, with responsible investment assets growing at 15 times the rate that overall Australian professionally managed investments have grown – the landmark annual study from the Responsible Investment Association Australasia (RIAA) has found.

The new RIAA report researched in collaboration with KPMG, Responsible Investment Benchmark Report Australia 2021, shows that the Australian responsible investment market reached new highs in 2020, increasing to $1,281 billion in 2020 from $983 billion in 2019.

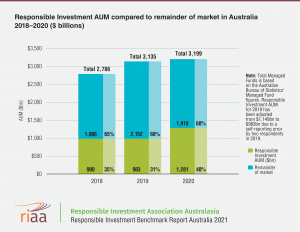

Additionally, the proportion of responsible investment AUM to total managed funds grew from 31% to 40% in 2020, despite there only being a 2% increase in all professional managed funds in Australia over the same period.

This shift is being fuelled by changing consumer expectations, strong financial performance and the rising materiality of different social and environmental issues – from climate change to racial inequity.

While the majority of the mainstream investment market claims to be responsibly invested, those funds engaging in leading practice responsible investment have seen an explosion in assets under management, growing 30% in 2020. This movement of capital has come at the expense of the remainder of the market, which has seen the value of assets shrink by 11% ($234 billion).

The message is clear. It’s not good enough to simply claim you’re investing responsibly. If you’re not doing it well, then there’s a high risk of losing business.

This year’s report announces Responsible Investment Leaders 2021; investment managers in Australia that demonstrate leading practice in their commitment to responsible investment, and their supporting integration and activity.

The report shows that just one quarter of investment managers are practising a leading approach to responsible investment, highlighting a continuing gap between investment managers that claim to be practising responsible investing and those that can demonstrate they are. The gap between responsible investment leaders and others is particularly pronounced in the area of stewardship activity, the reporting of outcomes, and specific allocation of capital to target social and environmental outcomes.

The report highlights an industry in transition. There are rapid developments taking place across countries, regions and markets that are resetting expectations of responsible investment. New standards and regulations are moving the industry towards best standards of practice that contribute measurably to a more sustainable world. Australia is no exception to this trend.

The report reinforces that responsible investments make good financial sense. In 2020, responsible investment funds performed on par with, or better than, the market, even though overall fund performance was down largely due to the impact of COVID-19 on economies worldwide.

The RIAA Benchmark Report is the most comprehensive review of the responsible investment sector in Australia. The 2021 report, the 20th such report, reviewed the investment practices of 198 financial institutions.

Read the report here: https://responsibleinvestment.org/resources/benchmark-report/