Ethical Investment.

Ethical or Responsible investment (RI) gives you a way to generate wealth over the long term using a prudent, sustainable investment strategy that reflects your personal values. We all want our superannuation and savings to be safe and earn a solid rate of return, but there are other things we care about too

You might feel passionate about the effects of climate change, the provision of affordable and accessible healthcare services, managing resources sustainably to meet our current needs and those of our aging and growing global population, and supporting the transition to a low carbon economy. RI gives you a way to make your beliefs and convictions an integral part of your financial decision-making.

Investing responsibly is also a way to support, and benefit from, solutions to life in the 21st century such as environmentally friendly technologies, sustainable agriculture, microfinance, medical technologies, recycling and waste management, and “green” infrastructure and transport projects.

You may have come across other terms such as impact, green, sustainable or socially responsible investing. These are all different names used to describe what is now most commonly referred to as ethical investment.

See also: What Is RI? and What is Ethical Investment?

Ask about our ‘Ethical Profiling Questionnaire’ which we use in our process to determine your investment criteria.

Ethical Investment Benchmarking

Outperformance over the Long Term.

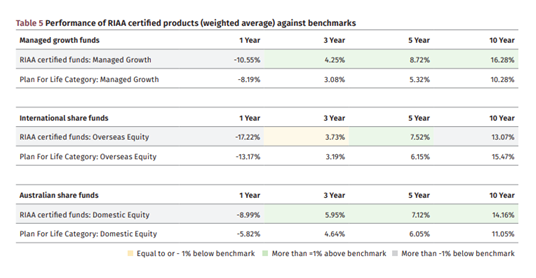

The Responsible Investment Benchmark Report 2023 includes an assessment of the performance of core responsible investment funds compared with their benchmark index and the average of equivalent mainstream funds. The results show that responsible investment funds are outperforming their average mainstream counterparts year on year, and that the market for ethical investment continues to grow at a rapid pace.

The following table shows performance figures as at September 2023 from RIAA’s Benchmark Report:

So why become an Ethical Investor?

The most common reasons why people decide to invest ethically are:

Competitive Returns

To generate competitive returns whilst making a difference to the environment or society.

Positive Difference

To ensure your money is directed towards companies making a positive difference to the environment and the impact of climate change whilst avoiding those that cause harm.

Influence Corporate Behaviour

As a way to influence corporate behaviour and push for greater accountability on issues like employment and trade conditions, environmental sustainability and good corporate governance.

Social or Consumer Activism

To take your social or consumer activism to the next level.

Ethical Investment Options

The range of ethical investments available in Australia is extensive and growing all the time. There are products or services for every life stage, time frame and risk profile.

Ethical investment is a way to generate competitive returns and find sustainable solutions to many of the challenges we face in the 21st century.

Managed funds

Managed funds and share portfolios (SMA’s) with a particular ethical (or RI) mandate are a common way to become a responsible investor. The fund manager may screen in or out certain sectors or companies based on their environmental or social impact; incorporate an analysis of environmental, social and governance risks and opportunities with traditional financial data; select only those companies scoring the highest sustainability rating; or invest along thematic lines

Superannuation Funds

Superannuation funds may offer one or more ethical investment options or integrate RI principles into their mainstream investment process for all of their options

Specialist Financial Adviser

A specialist RI financial adviser can help you design a wealth management plan based on the principles of RI using either managed funds or direct shares. James and Julianna at JustInvest have a long history of advising clients in this area. James is a Member (and former Chairperson) of the Ethical Advisers’ Co-op

‘Green’ Investing

You can open a savings or loan accounts with a bank or credit union that follows responsible lending and business practices or take out a “green” home or car loan.

Certified by RIAA

Ethical or Responsible investment is a strategy used by investors in order to incorporate environmental, social, governance (ESG) factors into their investment choices and ownership practices.

The Responsible Investment Certification Program is the first of its kind in the world and is owned and managed by the Responsible Investment Association Australasia (RIAA).

The Certification Symbol signifies that an investment product, service or policy takes environmental, social, governance or ethical considerations into account along with financial returns. James and JustInvest Financial Planning’s processes were also independently reviewed. Key details regarding the Certification are available through RIAA’s website. The Certification Symbol is a Registered Trade Mark owned and managed by RIAA. The Responsible Investment Certification Program does not constitute financial product advice.

See www.responsibleinvestment.org for more details.

The Certification Symbol signifies that James Baird of Ethical Investment Advisers offers Responsible Investment products; has undertaken continuing professional development on responsible investment; and conducts inquiries regarding client concerns about environmental, social, governance or ethical issues. The Symbol also signifies that James Baird has adopted strict disclosure practices required under the Responsible Investment Certification Program for the category of Financial Adviser. The Certification Symbol is a Registered Trade Mark of the Responsible Investment Association Australasia (RIAA). Detailed information about RIAA, the Symbol and James Baird can be found at www.responsibleinvestment.org, together with details about other responsible investment products and services certified by RIAA.