We hope you and your loved ones are safe and coping as best you can during these difficult times. Confirming that it is still business as usual for us – however we are now conducting all client meetings via phone and video conferencing, and working from home when necessary, to protect those most vulnerable to Coronavirus infection. You can still reach us on the phone or via email of course.

Please find below an update on the Government announced stimulus and bank support packages that may assist you financially in this difficult time. If you have any questions or concerns, please don’t hesitate to contact us.

The government’s latest suite of stimulus measures designed to handle the outbreak’s economic fallout were announced on Sunday afternoon, including the early release of super for Australians in financial stress as a result of the Coronavirus. The superannuation sector has been called on to act as a key pillar in Australia’s response to the Coronavirus, with partial access to super withdrawals a key component of the government’s new announcements. Here is a summary and some responses to common questions.

Eligible Australians will be able to draw up to $10,000 from their super accounts for the rest of this financial year, as well as an additional $10,000 over the 2020-21 financial year. These amounts will be tax-free. Additionally, the release of super under these circumstances will not impact an individual’s Centrelink or Veterans’ Affairs payments.

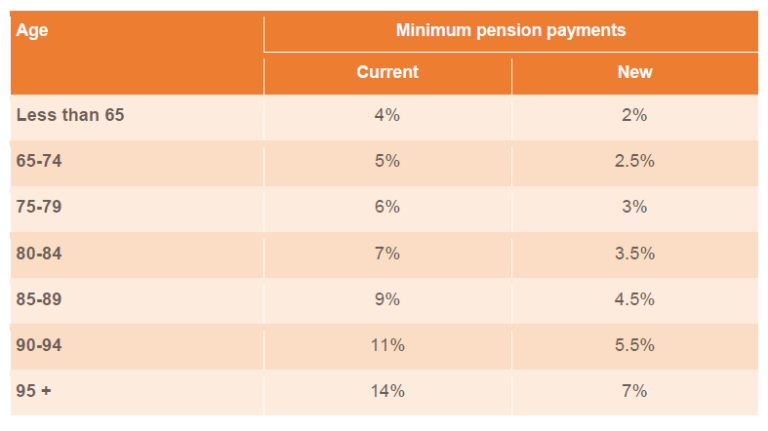

The government will also temporarily reduce super minimum drawdown requirements for account-based pensions and “similar products” by 50% for the rest of this financial year and 2020-21.

Q&A

Qn: Can I reduce my regular Pension income payments?

Self-funded retirees will have their pension minimums reduced by 50% for 2019/2020 and 2020/2021 financial years to 2% of the fund value. This measure is designed to take the pressure off anyone who doesn’t require access to their pension for personal cash flow. This will help retirees avoid selling down assets and realising losses, instead, it will allow their capital to remain in the market as it recovers.

We saw this measure work effectively during the Global Financial Crisis and we will be contacting our clients to discuss their pension requirements for the foreseeable future. For Information: https://treasury.gov.au/sites/default/files/2020-03/Fact_sheet-Providing_support_for_retirees_to_manage_market_volatility.pdf

Qn: How much of my super can I access if I am under ‘financial stress’ as a result of Coronavirus?

You may be eligible to access two lump sums of $10,000 from your super under this condition. The first payment must be applied for before 1 July 2020. You may be eligible to claim a second payment of $10,000 from 1 July for approximately three months.

To be eligible, you must meet one of the following conditions:

- You are unemployed

- You are eligible to receive Jobseeker Payment, Youth Allowance (jobseekers), Parenting Payment, Special Benefit or Farm Household Allowance

- On or after 1 January 2020, you were made redundancy, your hours of work reduced by at least 20%, or if you’re a sole trader, your business was suspended or your turnover reduced by at least 20%.

Applications will be made via the MyGov website, and you’ll need to certify that you meet one of the above eligibility requirements. Once the ATO confirms you’re eligible, they will issue you and your super fund with a determination and the payment will be made to you. If you have a Self-Managed Super Fund (SMSF), arrangements will differ and additional information will be provided by the ATO.

These payments will be tax-free and won’t be assessable when determining your entitlement to Centrelink or DVA entitlements. You can apply to access your funds under this condition of release on MyGov. It is expected that claims can be made from mid-April (note: the MyGov website has been under pressure and has crashed today).

Qn: Am I eligible for a $750 cash payment?

Two payments of $750 each will be paid to eligible income support recipients and concession card holders. The first tax-free payment will be available to eligible income support recipients as at 12 March 2020 and is expected to be automatically paid to eligible recipients from 31 March 2020. The second payment will be available to those who aren’t eligible for the Coronavirus supplement (below) and will be automatically paid from 13 July 2020.

Qn: What is the Coronavirus Supplement?

The Coronavirus supplement of $550 per fortnight will be paid to new and existing recipients of:

• JobSeeker Payment

• Youth Allowance (Jobseeker)

• Parenting Payment

• Farm Household Allowance, and

• Special Benefit

The supplement will be paid over the next six months and will be paid automatically with the person’s ordinary fortnightly entitlement. It will be paid from 27 April.

Qn: Does my risk insurance policy cover Coronavirus and other pandemics?

This can vary from one policy to another, subject to policy wording. However most life insurance policies will cover pandemics. Some policies provided through employer or industry super funds may have pandemic exclusions, usually when death, total and permanent disability or an illness related to a pandemic occurs shortly after cover commences (eg within 30 days). Beyond this, most policies will pay in the event that a death, disability or illness results from a pandemic (and where all other policy conditions are met).

Qn: If I can’t work because I have been diagnosed with Coronavirus, or I am required to self-isolate, can I claim on my income protection policy?

As most people who have been diagnosed with Coronavirus have recovered quite quickly, you may not be able to claim on your income protection policy. This is because you need to be disabled (as defined in the policy) for the duration of the waiting period, which can be a short as 14 days, but is most likely between 30 and 90 days. Also, if you’re receiving sick leave or other special leave payments from your employer during this time, you may not be eligible to receive additional payments from income protection cover, subject to the policy wording.

Qn: What Support Packages have been announced by Banks?

Many banks have announced hardship provisions to assist in the recovery from the current crisis. Please check with your own bank, but a summary of the general provisions is outlined below.

Most banks look to be offering the option to defer home loan repayments for three to six months. Under a home loan repayment deferral, customers do not need to make repayments to their home loan for a period of time. Unpaid interest during this period is capitalised, meaning it is added to the customer’s outstanding loan balance to be paid over the remaining loan term.

For customers ahead in their home loan repayments there may be options such as accessing their existing redraw balances or using funds in their offset or deposit accounts. For the majority of customers who pay more than the minimum home loan repayment amount, they can reduce their monthly payments to the minimum repayment amount through internet banking. Many banks are also offering a reduction in their variable home loan interest rates.

To find out more about these are any other issues or concerns you may have, we recommend you contact us. In the meantime, take care.